what is tax planning explain its importance

Discuss the historical background of Income tax. Fidelity Tax Account System as of 12312019.

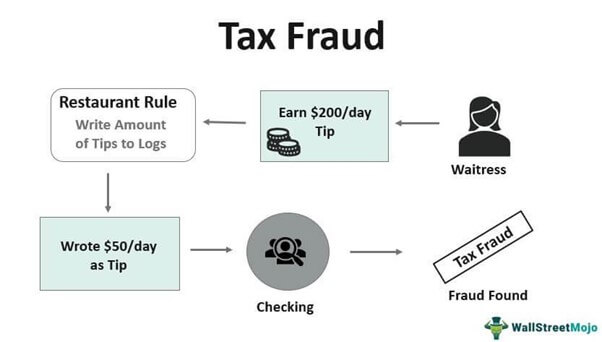

Tax Fraud Definition Types Examples Punishment

Then decisions have to be made about how that funding must be.

. In fact a recent survey of tax executives found that 84 of the publicly traded firms that responded. Businesses will have a larger base of customers who can purchase their products and services and the city will earn tax income to continue to support important programs and reduce debt. Planning process forces managers to think differently and assume the future conditions.

The UK and Welsh Governments recently announced measures to help protect millions of households from rising energy costs in 2022-23. These statements serve a dual purpose. What is net tax.

Is a contract that supports all Federal agencies for strategy planning process and performance improvement employee engagement and. Importance of Business Environment. 2014 page 16 Publications.

Just like us business operations do not survive in confinement. The uncertainty around government funding can make it very difficult for museums to engage in long-term planning if they are not sure of their budget a year or two in the future. The Importance of Engagement Letters Dec.

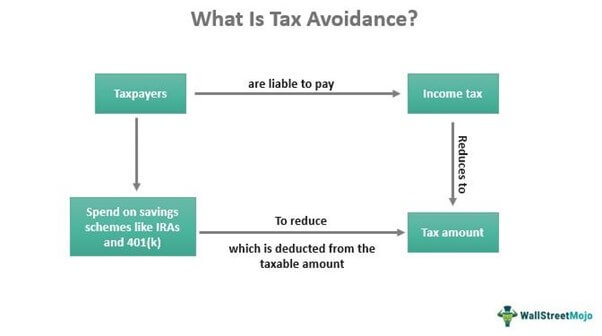

While corporate tax avoidance generates tax savings as with other operational investments it incurs significant costs. The organizations culture is often the most important determiner in successful execution. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount.

Search warrants for tax and tax-related offenses will be utilized with restraint and only in significant tax investigations. If you need more help getting a business or organization prepared please use the new Business Continuity Planning Suite ZIP Archive - 13 Mb. Explain the meaning of income received or deemed to be received in India.

When community development is effective there is less crime less disparity between citizens better jobs available a more talented workforce and less. In our analysis over the past three years cumulative tax savings from tax-loss harvesting differed from year to year and was as small as half the amount shown in the chart. DHS and FEMA created the Business Continuity Planning Suite for any business with the need to create improve or update its business continuity plan.

Chen and Lin 2017 meaning that the firms engage in tax planning to generate additional cash for use as internal funds. The funding given to cultural institutions has to be balanced with its relative need and importance. Scenario planning enables leaders to consider multiple uncertainties such as these and integrate them into logically consistent wholes.

The business environment brings both threats and opportunities to a business. Best Practices and Examples APAEGLO one-year online access. It Helps in Assisting in Planning and Policy Formulation.

A mission statement is a short sentence or paragraph used by a company to explain in simple and concise terms its purposes for being. So it makes the managers innovative and. Get study material books syllabus ppt courses question paper questions and answers.

One is through dividends meaning a payment of a certain amount of money per share to investors. What is its importance. Increase in goods and service tax to 15 would increase the revenue of the government.

These measures include a one-off 150 non-repayable rebate for eligible households in Wales in council tax bands A-D along with those households in council tax bands A-I that receive Council Tax Reduction formerly known. We applied the clients ordinary income tax rate to short-term losses and capital gains tax rate to long-term losses. The group emphasized the importance of whats called a just energy transition from a fossil-fuel economy to a green one a shift that would create thousands of jobs in the renewables.

We would like to show you a description here but the site wont allow us. An organization must be able to efficiently execute that strategy to achieve its performance improvement goals. Planning requires high thinking and it is an intellectual process.

It is a tool that can be used for learning and faster adaptation to changing circumstances. So there is a great scope of finding better ideas better methods and procedures to perform a particular job. Planning Promotes innovative ideas.

The IRS knows it needs to do better in engaging with taxpayers and easing. PC Compatible developed by DHS National Protection and. Scenario planning should be dynamic constantly adapting to changes in the broader landscape.

Investors hire portfolio managers and avail of professional services to manage portfolios by paying a pre-decided fee for these services. One way to increase internal funding is through cash savings from tax planning Edwards et al 2016. Download Corporate Tax Planning Notes PDF for B COM BBA 2nd year.

Dividends are paid out of profits. The CPAs Guide to Developing and Managing a PFP Practice PCPAGDMO one-year online access. All other investigative tools ie mail covers surveillance informants trash pulls should be considered before deciding that a search warrant is the least intrusive means to acquire the evidence.

Let us understand who a portfolio manager is and the tasks involved in managing a portfolio. Analysts and investors frequently use a companys ETR to analyze its performance leading companies to stress the calculation of the income tax provision under Topic 740 almost as much as they emphasize cash savings from income tax planning. The bill requires the IRS to explain its spending plans and provide updates at certain mile markers Holtzblatt noted.

A company can return its profits to its investors in two ways. JofA article Professional Liability Spotlight.

Importance Of Tax Planning For Corporates And Individuals

Trump S Tax Plan And How It Affected You

Tax Planning For High Net Worth Individuals Bmo Private Wealth

Why It Matters In Paying Taxes Doing Business World Bank Group

What Is Tax Planning Definition Objectives And Types Business Jargons

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

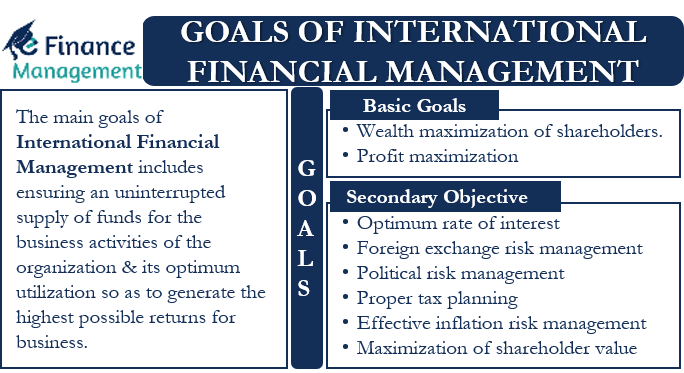

Goals Of International Financial Management Basic And Secondary Goals

Tax Avoidance Meaning Methods Examples Pros Cons

What Is Financial Planning Types Meaning Objective Importance Faqs

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Tax Planning Meaning Importance It S Benefits Edelweiss Mf

What Is Tax Planning Definition Objectives And Types Business Jargons

Investment Planning Definition How To Prepare For Your Future Private Advisory Vancouver Bc

Tax Avoidance Meaning Methods Examples Pros Cons

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/147323400-5bfc2b8c4cedfd0026c11901.jpg)